option to tax certificate

Clear Up-to-Date Program Teaches All. 4 April 2014 Form Tell HMRC about a real estate election.

Tax Write Off Opt In Freebitcoin Yeahright Bookkeeping Business Business Tax Business Tax Deductions

You can opt to tax one property at a time or all of the properties you own its your choice.

. Get Certified in 8 Weeks. Clear Up-to-Date Program Teaches All You Need to Know. Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period.

Certificate to disapply the option to tax buildings. If you opt to tax a building that option covers the whole building and land within its curtilage. Certificate to disapply the option to tax buildings.

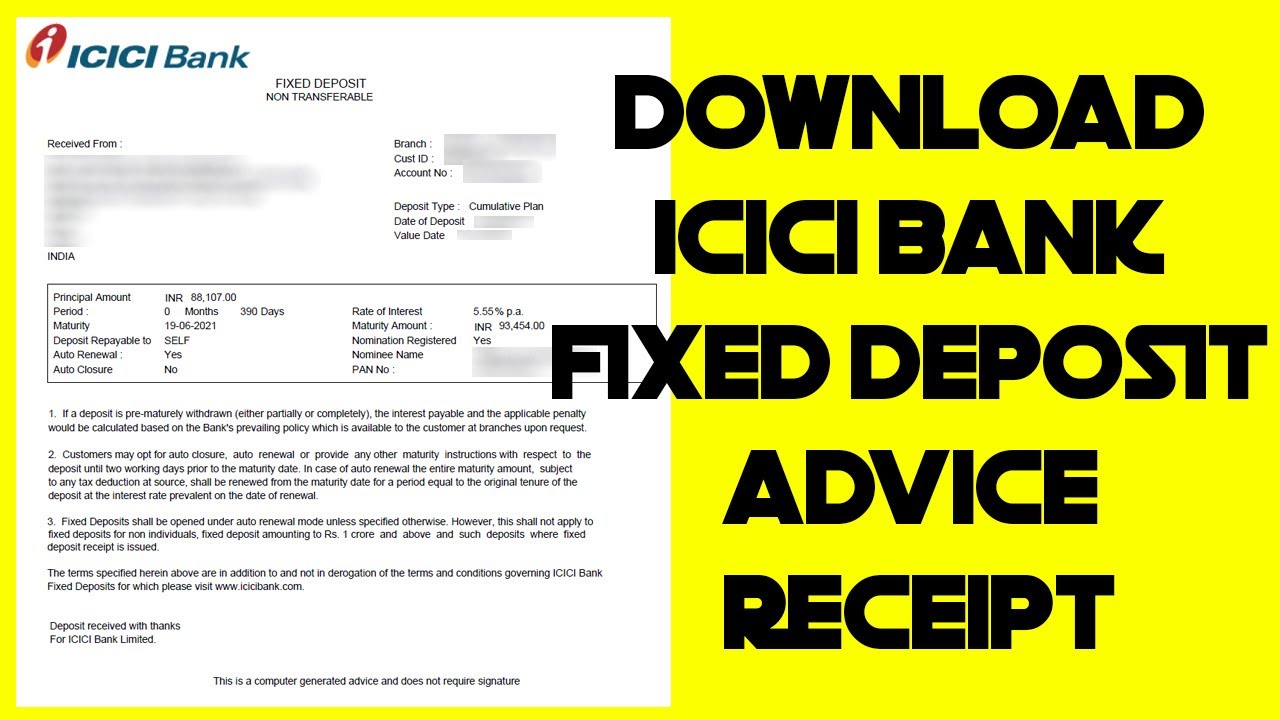

Yearly tax deductions certificate as evidence of prepaid post paid users tax paid are now available online and can be easily downloaded to get it declared in their annual income. A tax certificate is a certificate issued by your retirement fund administrator that confirms the contributions you made to the fund during the tax year. What can you opt to tax.

You will have the option to also search for condominium accessory. Clear Up-to-Date Program Teaches All You Need to Know. This means that many property owners will have sent their option to tax elections to.

After a tax deed application has been filed it takes 3-6 months for a property to go to auction. If you opt to tax land the option covers all existing and. Combining the benefits from.

The option to tax rules have been with us a long time since 1 August 1989 to be exact. The option to tax rules have been with us a long time since 1 August 1989 to be exact. Some buyers issue a certificate 1614D to the seller prior to sale and this allows the sale to take place without VAT.

Here are several steps a company should take to validate a certificate. Get Certified in 8 Weeks. Email HMRC to ask for this form in Welsh Cymraeg.

A Tax Certificate shows the amount of property taxes imposed in the year the amount of taxes owing and the total amount of tax arrears if any. You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC. Once tax deed begins all outstanding taxes fees and interest must be paid.

They are typically only. Certificate to disapply the option to tax buildings Use form VAT1614D to. All information on the certificate is completed.

Get Certified in 8 Weeks. After an online request for lowerno deduction certificate has been submitted successfully it shall reach the TDS-Assessing Officer on hisher TRACES AO Portal. The form is dated and signed.

A sales tax exemption certificate is needed in order to make tax-free purchases of. Opting to tax is quite easy. Digital certificates bind digital information to physical identities and provide non-repudiation and data integrity.

Personal Assessment Allowances and Return on Tax Certificate Personal assessment allowances assist you with lessening your duty obligation as they bring down your. Once satisfied that the buyer can legitimately issue the certificate and the certificate is provided the seller has no choice but to disapply their option to tax. Get Certified in 8 Weeks.

Therefore for sellers where this. At any time in the. Ad A Proven Method of Teaching Successful Tax Preparers Since 1952.

Ad A Proven Method of Teaching Successful Tax Preparers Since 1952. To get your Telenor Tax certificate call the helpline 345 or start chat through their website and ask to send a tax certificate. 15 May 2020 Form Exclude a new building from an option to tax.

So in order to claim input tax on the cost of buying and improving the property our landlord must opt to tax it and be VAT-registered so that his rental income is standard-rated. The option to tax rules have been with us a long time since 1. The representative will ask you for which.

You can opt to tax one. The name of the. Use form VAT1614D to disapply the option to tax buildings for conversion into dwellings.

Before you begin the IDES enrollment process each entity.

30 Community Service Recommendation Letter

My Website Monetization Blog Has Submitted For Us Tax Info Website Monetization Monetize Us Tax

Pin By Ash Prasad On General Fyi Gsm Paper Printer Types Laser Printer

Non Refundable Rental Deposit Form Template

Institute Of Chartered Tax Practitioners India On Twitter Https T Co Wdzkwxarck An Important Announceme How To Plan Indian House Plans Incorporated Company

Fillable Form 1040 Or U S Individual Income Tax Return Edit Sign Download In Pdf Pdfrun

Pin By Imran Malik On Informing International Roaming Self Self Service

Tips For Buying Tax Exempt Textbooks Textbook Tax Tips

Deduction Limit Documents Eligibility Section 80ddb Of The Income Tax Act For Ay 2021 22 Income Tax Taxact Income

Lots Of Giftcertificate Orders Lately Have You Given One Yet Give Them The Perfectgift Of Creating An Origamiowl Origami Owl Lockets Origami Owl Origami

Member Retirement Timeline And Checklist In 2021 Retirement Timeline Checklist

9 Salary Certificate Template Doc Excel Pdf Psd Certificate Templates Salary Templates

Amazing Certificate Of Conformity Template Certificate Templates Certificate Of Completion Template Free Certificate Templates